where does credit score start canada

A credit score is essentially a numeric rating that banks lenders use to qualify you for a loan. Canada uses two of the major.

Credit Score Requirements For Credit Card Approval Moneyunder30

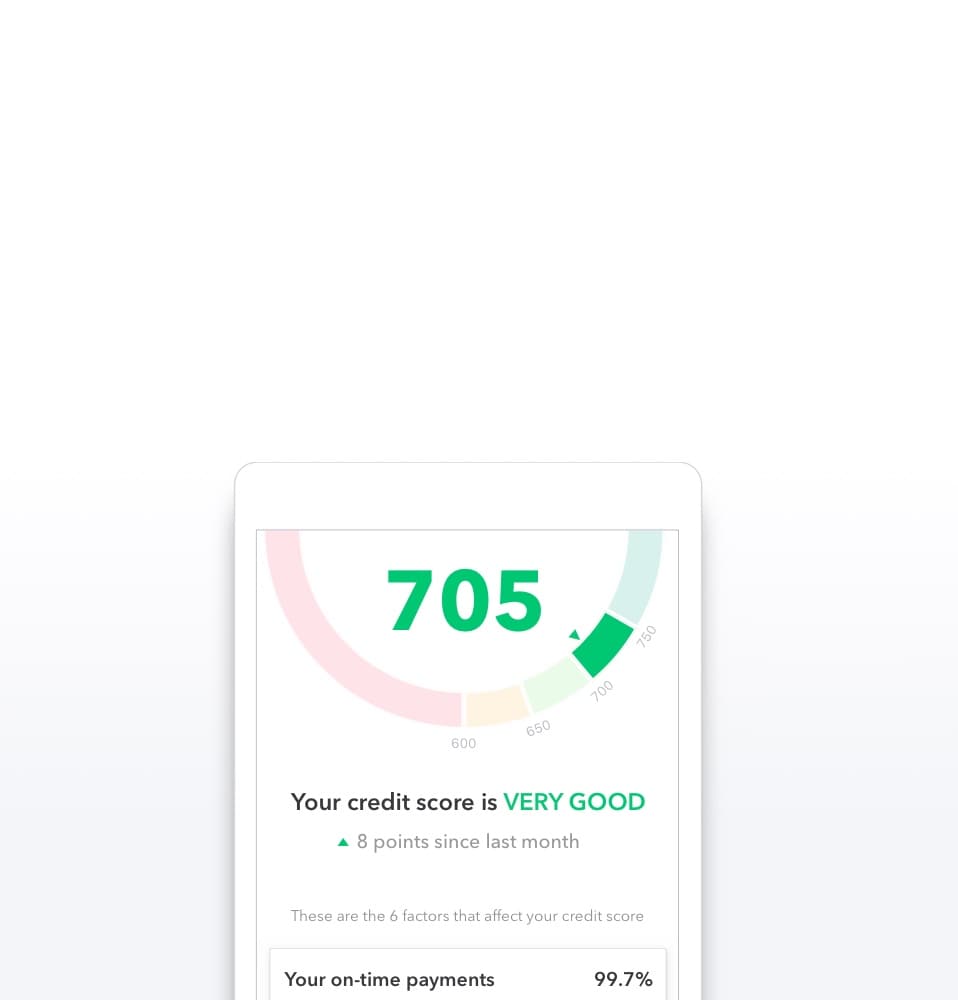

Your credit score is a three-digit number that comes from the information in your credit report.

. When it comes to credit scoring systems Canada is similar to the United States. Its d none of the above. Credit scores have little to no impact on the immigration process.

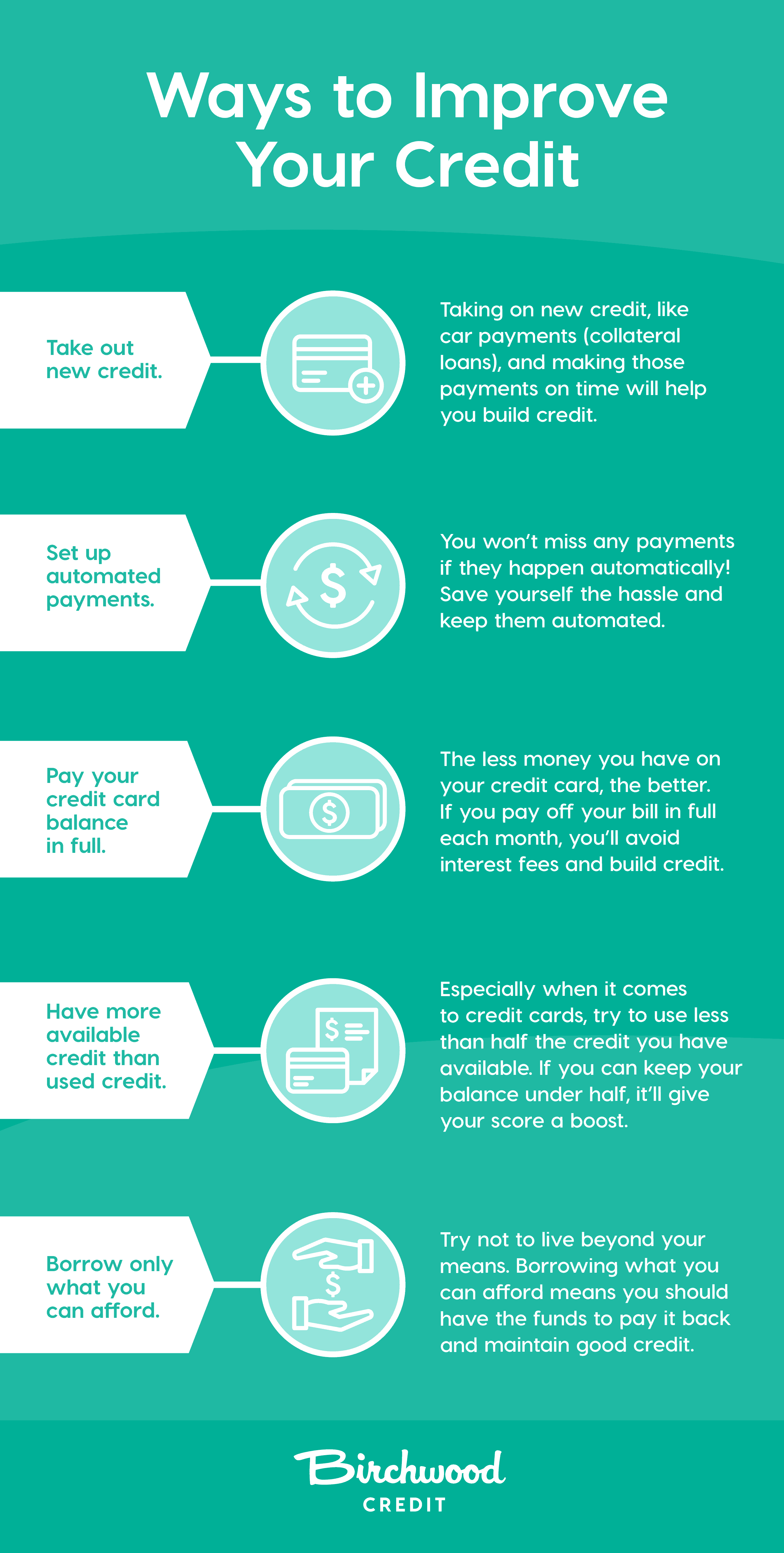

Your starting credit score will fall below the median number of 723 even if you pay all of your obligations on time and according to terms during the six. Differences Between American vs. The better credit score you have the easier time youll have getting approved for things.

Keep in mind that this score is just an average taken by accounting for. In reality everyone starts with no. Credit scores range from 300 just getting started 650 the magic middle number.

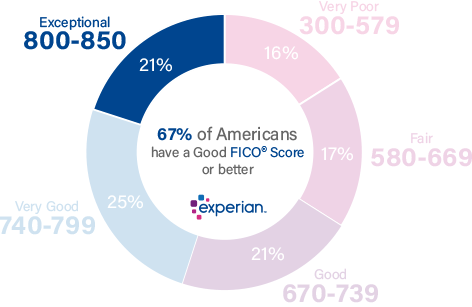

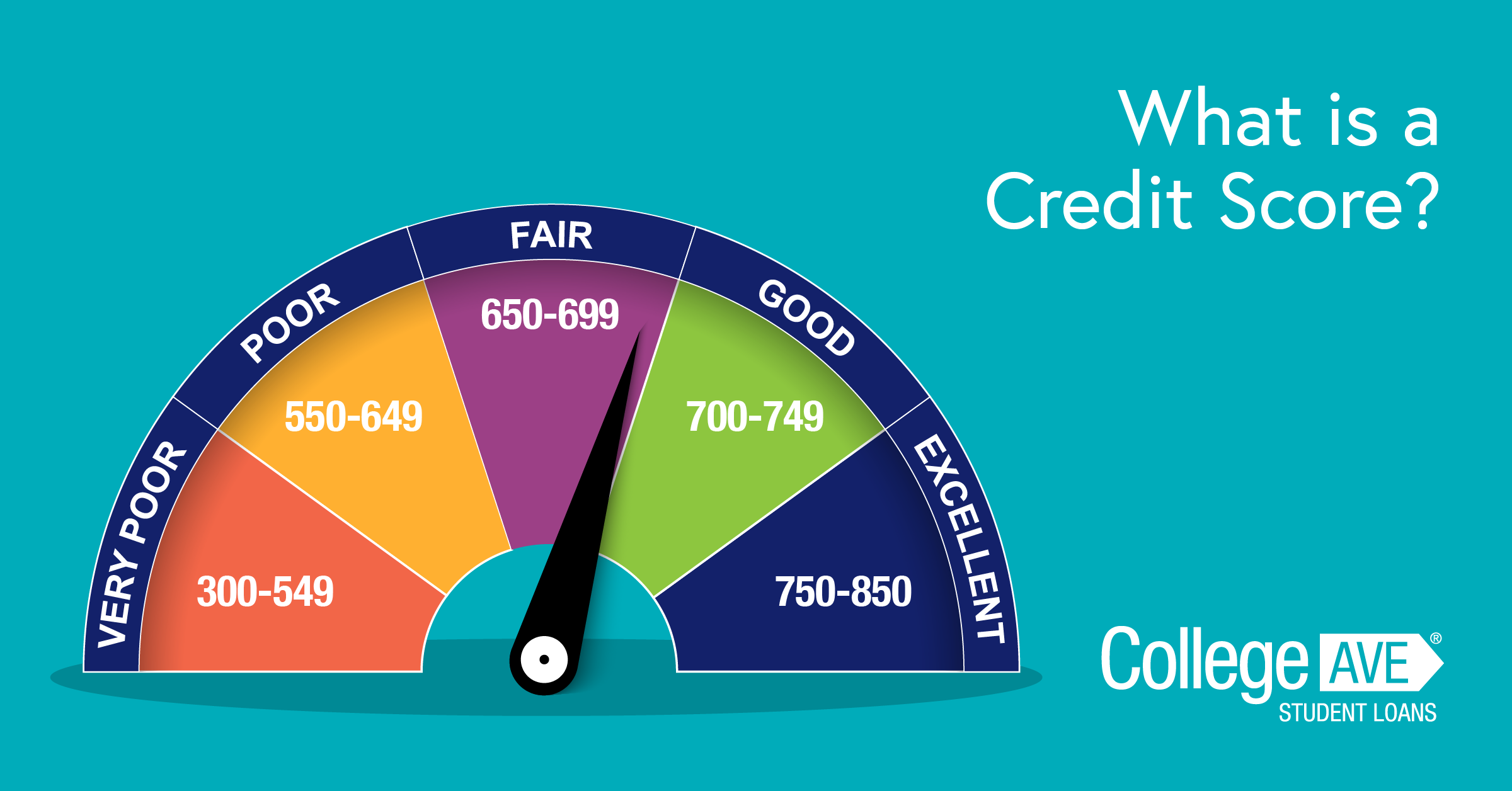

While both share FICOs common credit score model the average credit score in Canada. Do you begin at a the highest possible credit score b the lowest or c somewhere in between. In Canada credit scores range between 300 and 900 with a higher score being better.

Similarly a foreclosure means a credit score falls 140-160 points if your original credit score was 780 but falls only 85-105 if your original credit score was 680. In TransUnions view a score that is above 650 will likely allow you to receive a standard. On average Canadians within the youngest age bracket 18 25 have a credit score of 692 while the oldest 65 have a credit score of a little over 740.

A better credit score. Unfortunately the answer is no. According to TransUnion credit score ranges are categorized as follows.

The answer may surprise you. Your credit score an all-important number ranging from 300 to 900 tells lenders in Canada how trustworthy you are and whether you deserve a good deal on a credit card. Learn more about how your credit score is calculated.

Experian offers a detailed explanation why not citing the following reasons. Heres how some other countries around the globe measure credit. In Canada credit scores can be as high as 900 and as low as 300 but dont worry.

725-759 is very good. Your credit score an all-important number ranging from 300 to 900 tells lenders in Canada how trustworthy you are and whether you deserve a good deal on a mortgage credit. Thats because your credit score from your home countrygood or badwont carry over to Canada.

Canadian credit scores range from 300 on the low end to 900 on the high end whereas credit scores in the US. Your credit score from Equifax is accessible online for. For example Canadian credit scores range from 300-900 while US credit scores range from 300-850.

According to Borrowell the average Canadian credit score is 672 which is considered a fair score. If youve never had credit activity a credit card or loan or instance you wont start at 300. You can access your credit score online from Canadas 2 main credit bureaus.

Some countries have laws that prohibit the transfer. The higher the better. It shows how well you manage credit and how risky it would be for a lender.

Credit scores in Canada range from 300 to 900. In Canada you will get credit scores as high as 900 points as a simple starting point.

Free Credit Score Free Credit Report With No Credit Card Mint

5 Steps To Rebuilding Credit In Canada Credit Counselling Society

815 Credit Score Is It Good Or Bad Experian

:max_bytes(150000):strip_icc()/credit-score-4198536-02-FINAL-e9274c28e19c4ca1bb6dddd043aca95b.png)

Credit Score Definition Factors And Improving It

What Does A 700 Credit Score Mean In Canada

What Is A Good Credit Score In Canada And How To Improve It

What Is My Real Credit Score The One Lenders See The Dough Roller

Credit Score Range What Is The Credit Score Range In Canada

:max_bytes(150000):strip_icc()/how-long-it-takes-to-build-good-credit-4767654_final-5b370f861f4f42e5975e63c6bbeb2784.gif)

How Long It Takes To Build Good Credit

Does Financing A Car Build Credit

Credit Score Range What Is The Credit Score Range In Canada

Credit Scores Credit Reports Credit Check Transunion

How To Check Your Credit Score Consolidated Credit Canada

How To Build Credit In Canada Tips And Tricks Refresh Financial

Student Credit Scores A Guide For College College Ave

What Is A Good Credit Score In Canada And How To Improve Yours Moneygenius

How Accurate Is Credit Karma Reviews Safety And Other Things To Know

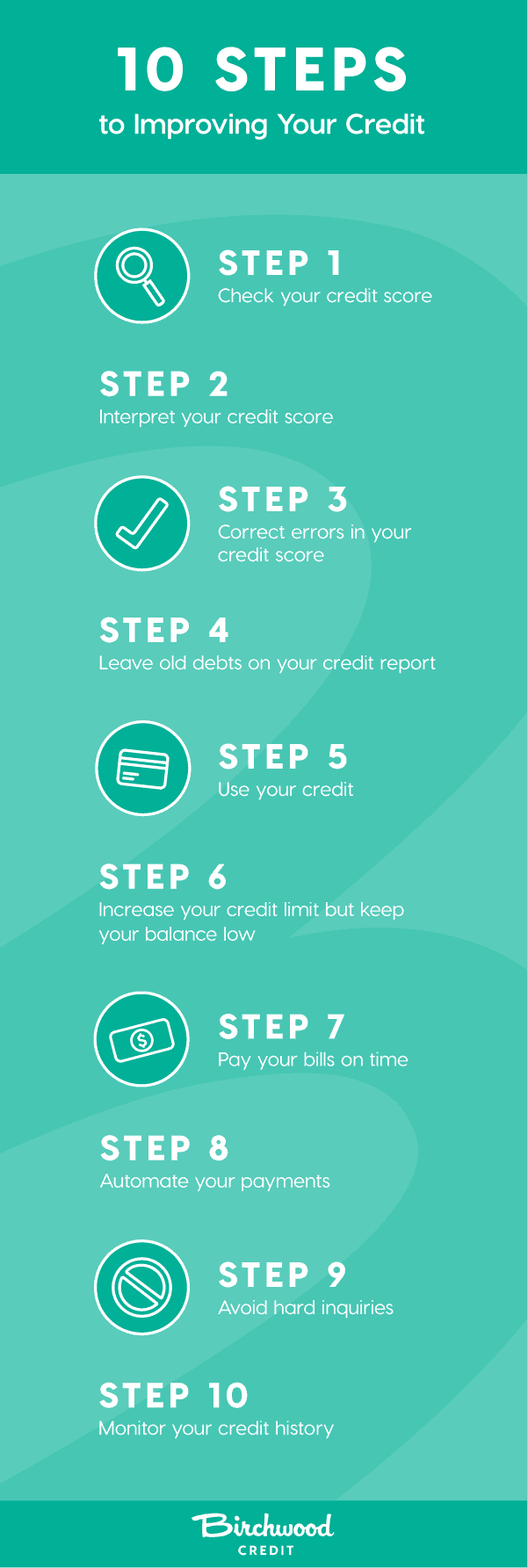

Learn How To Improve Credit Score In Canada With These 10 Steps